It's still early days. The first open enrollment of the Obamacare marketplaces is ongoing. But the Covered California marketplace is more competitive than the 2012 individual market, according to a new analysis from the Kaiser Family Foundation. Entirely by coincidence, the study, released Monday, coincided with the news that Covered California had passed the million mark in enrollment.

Analysts looked at exchange data from seven states, including California. Enrollment for people buying outside exchanges, on the individual market, will not be available until later this year or early 2015, Cynthia Cox, one of the foundation's analysts noted.

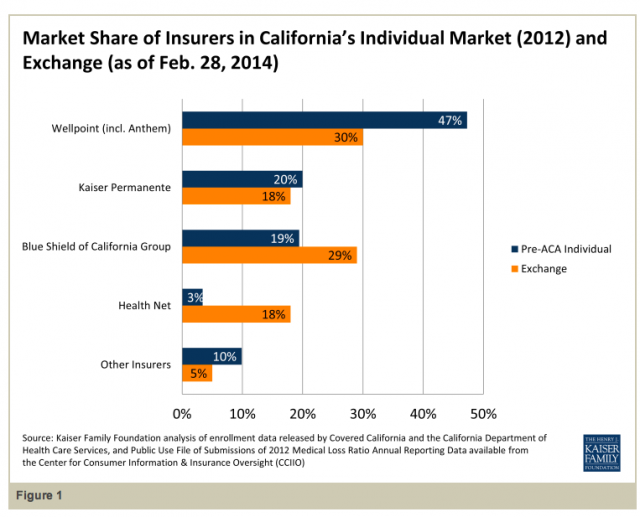

"California had a highly concentrated market before the ACA," Cox said. But the Covered California marketplace has both more companies with greater than 5 percent market share and the percentage marketshare of the largest company has declined, as shown in this graph from the study:

Anthem Blue Cross had nearly half (47 percent) of the individual market in 2012, but 30 percent of the Covered California market, as of Jan. 31. Health Net, conversely, has seen its marketshare increase substantially.

"Very much so," Cox said. "It was only a tiny fraction before [3 percent] and now it controls over a fifth, and it's largely because they priced relatively low in Southern California."