The House has narrowly approved a $1.4 trillion tax overhaul, clearing the first major hurdle in Republican attempts to cut taxes and rewrite the tax code.

The vote was almost along party lines, with no Democrats voting in support of the bill and some GOP defections over provisions in the measure that would eliminate important tax deductions taken by constituents in some high tax states.

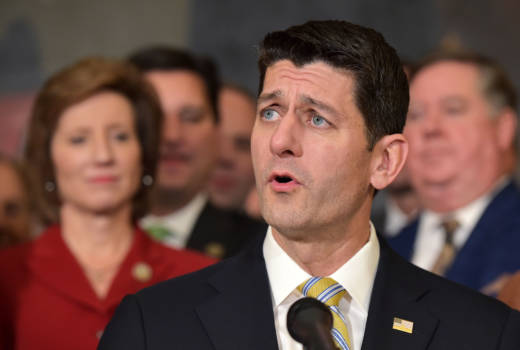

"It has been 31 years since we last did this, and it is finally time that we get the general interest of this country to prevail over the special interests in Washington," House Speaker Paul Ryan said on the House floor, pledging that the bill would leader to faster economic growth and bigger paychecks for American workers.

The last major tax overhaul took place in 1986 under President Ronald Reagan, with a Republican-controlled Senate and Democratic-controlled House.

9(MDAxOTAwOTE4MDEyMTkxMDAzNjczZDljZA004))