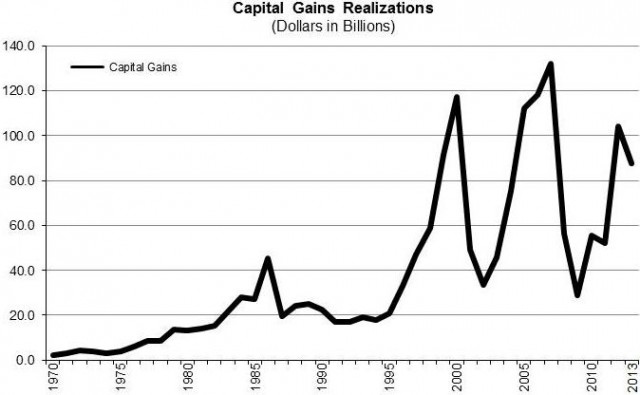

Capital gains tax revenue dropped by $7 billion during the last recession – that’s more than what this year’s budget would spend on all human services programs.

How does one area of revenue play such a big role in California’s budget health? It’s really a problem caused by the top 1 percent of the income tax bracket. “The personal income tax makes up about two-thirds of the state’s general fund,” said Sisney. “And the fraction of the personal income tax that’s paid by the 1 percent of returns with the most income has often been around 40 percent, or even more.”

One reason the top 1 percent of taxpayers accounts for 40 percent of the income tax California takes in each year is because the state taxes higher earners at higher rates. And these extremely rich people have been earning a lot more in recent decades. They also make most of their money off stock market earnings and real estate sales, as opposed to a regular paycheck -- thus the capital gains fluctuations.

Gov. Brown’s plan is to prevent lawmakers from spending all of that tax revenue in the flush years. If capital gains revenues swell beyond 6.5 percent of California’s budget, the proposal would sock away anything over that into a rainy day fund.

The proposal initially came from Assembly Speaker John Perez. “When we have these wild fluctuations, if we didn’t establish a meaningful rainy day fund like the one we’re proposing, what you have is massive cuts as the ones we saw over the last couple years,” said Perez. “Huge impacts on local governments. Huge impacts on education. Huge impact on doing business with the state.”

A broader approach

Perez said if his plan had been in place before the last recession, it would have reduced the state’s shortfall by half. Not everyone is so optimistic, though.

Gerry Parsky led the last major effort to try and fix this problem. He chaired a 2009 commission on tax volatility put together by then-Gov. Arnold Schwarzenegger. Its proposed solution was much more drastic: flatten out the income tax brackets so wealthy earners aren’t paying much more than everyone else, and completely rewrite California’s commercial and sales taxes.

Parsky said he’s “very skeptical “ of the latest rainy day fund proposal. “It’s impossible to deal adequately with volatility without changing the mix of the personal income tax, the corporate tax and the sales tax,” he said. “You certainly can’t do it with what I would call a weak rainy day fund." Weak, said Parsky, because income tax would still account for two-thirds of the state’s tax revenue, and it would still be rocketing up and down.

But Perez said he and Brown aren’t interested in flattening out income taxes. “In essence what (Parsky) is suggesting is, 'Let’s tax middle-class families more and let's tax the wealthy less'. And I don’t think that that is good policy or good politics,” said Perez.

War of the Rainy Day Funds

A rainy day fund isn’t a new idea. In fact, voters approved one a decade ago. But it went into effect just before the last recession, so it never really got a chance to work. Governors can opt out of contributing money to it, which is what both Brown and Schwarzenegger have done since 2007. (Brown’s latest budget proposal would contribute more than $1 million to the fund, though.)

There’s actually another new rainy day plan on this year’s fall ballot as well. It was drafted as part of the 2010 budget deal – Schwarzenegger’s last -- and then delayed. This ballot measure would make it more difficult to avoid payments. It determines excess tax revenue by averaging out the last 20 California budgets.

Brown spokesman H.D. Palmer said that approach wouldn’t really fix the problem of volatile tax revenue. That’s why Brown and Perez want to replace it with their new plan, “so we believe that what’s on the ballot currently is an improvement over what current law is now. We think that this proposal deals with the issue of the fluctuations of the state’s revenue in a much better manner,” said Palmer.

Brown wants his rainy day fund proposal on the November ballot. It would be a constitutional amendment, so that means two-thirds of the Assembly and Senate need to OK the plan by the end of June.