by Frances Dinkelspiel, Berkeleyside

The state Board of Equalization and Berkeley Patients Group (BPG) have worked out a compromise that reduces the dispensary’s delinquent tax bill from $7.5 million to $49,500.

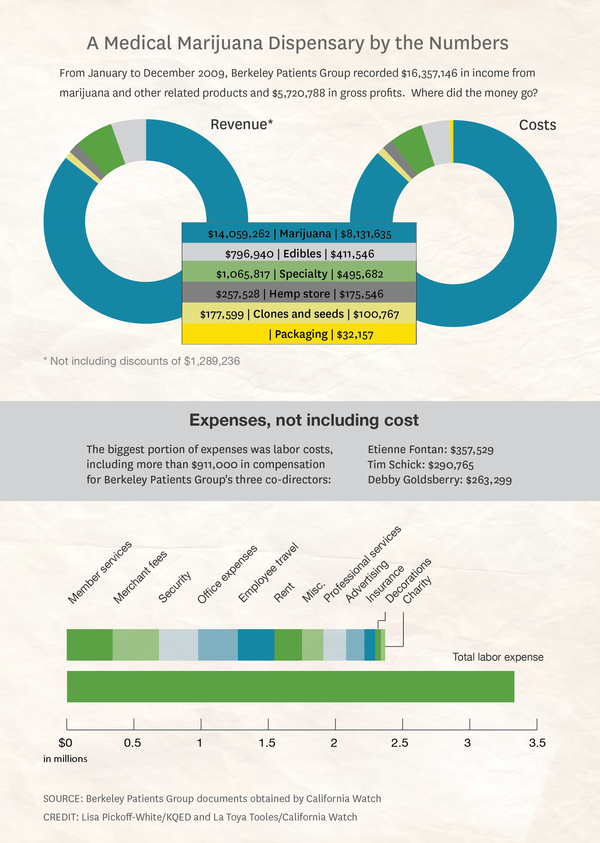

Despite selling millions of dollars in medical cannabis each year and paying its top executives close to $1 million in salaries, BPG told the state it could not afford to pay the taxes and interest it owed for the years 2004 to 2007, according to a document prepared by the Board of Equalization. At its Dec. 18-19, 2012, meeting, the board voted unanimously to accept a compromise payment of $49,500.

“The amount of the accepted offer, $49,500, represents the most the state can expect to collect from the taxpayer’s assets or income within a reasonable period of time,” reads the board’s public record statement prepared on the case. “The taxpayer does not have reasonable prospects of acquiring increased income or assets that would enable the taxpayer to satisfy a greater amount of liability that the compromised account within a reasonable amount of time.”

BPG did not pay taxes from 2004 to 2007 because the laws concerning medical cannabis were murky. BPG and other dispensaries believed cannabis was classified as medicine and therefore was exempt from sales tax. The equalization board ruled in September 2010 that medical cannabis is not a medicine and is not exempt. It audited BPG and informed the dispensary that it was liable for $4.4 million in back taxes plus interest. The Patients’ Care Collective, another Berkeley dispensary, was informed it owned $639,000 in back taxes. ![]() Berkeley Patients Group entered into the “Offer in Compromise” program with the board, which allows a corporation or individual to pay off delinquent taxes in installments or work to negotiate down the payment. The staff of the board determines the amount, and the five elected board members can only accept or reject the compromise, not make independent queries, according to Betty T. Yee, who represents Northern California.

Berkeley Patients Group entered into the “Offer in Compromise” program with the board, which allows a corporation or individual to pay off delinquent taxes in installments or work to negotiate down the payment. The staff of the board determines the amount, and the five elected board members can only accept or reject the compromise, not make independent queries, according to Betty T. Yee, who represents Northern California.