California Governor Jerry Brown’s new $122.5 billion budget proposal, released on Tuesday, reflects a cautious approach. With the state projected to run a $1.6 billion deficit, Brown said it was time to be prudent in spending on areas like education, child care and housing. Brown also warned of future economic downturns and a changing political climate in D.C. The governor also asked California legislators to approve the state’s cap and trade program in hopes of solidifying its financial success. In this hour, we’ll analyze Brown’s proposed budget and the future of California’s fiscal state.

Gov. Brown Submits Cautious Budget for California

51:37

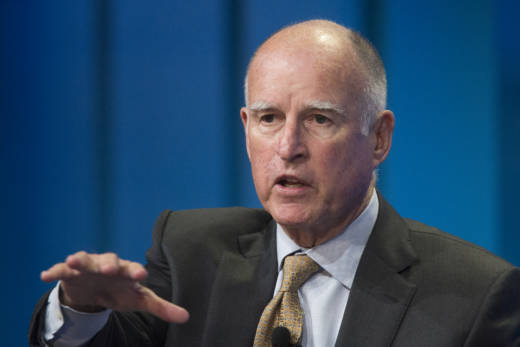

California governor Jerry Brown talks about new efforts to cope with climate change during a panel discussion at the 18th annual Milken Institute Global Conference on April 29, 2015 in Beverly Hills, California. (Photo: David McNew/Getty Images)

Guests:

Marisa Lagos, reporter, KQED's California Politics and Government Desk

H.D. Palmer, deputy director, external affairs at California Department of Finance

David Chiu, assemblymember District 17, California State Assembly

Jessica Calefati, education reporter, CALmatters<br />

Sponsored