The supporters of Measure D see it as the next chapter in Berkeley’s history of social activism. Dr. Vicki Alexander has been working on public health and other social issues in this community for half a century.

“My entire family has been a part of activism around Berkeley," says Alexander. "The Free Speech Movement the Free Mandela Movement -- just one after another after another -- we were involved."

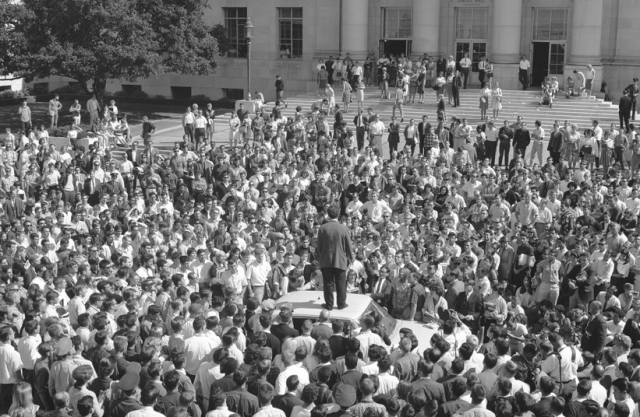

Alexander was there 50 years ago at UC Berkeley confrontation at Sproul Hall between students and the administration -- a confrontation credited with launching the Free Speech Movement. Berkeley also helped launch an effort toward healthy eating, led by Alice Waters and Berkeley's schoolyard gardens.

Two years ago, funding cuts threatened some of those gardens, and the seed was planted for the beverage tax, says Alexander.

“The parents of the kids who benefited from the gardens in the schools," Alexander says, "and people in the community who benefited from the gardens started [asking], 'How can we have a source of funding that's ongoing?'”

Building A Coalition

They knew they were taking on a tough opponent -- the beverage industry. Beverage taxes have been tried in 30 cities and states. They've all failed.

The opposition often successfully argues that this kind of tax would hurt low-income minority communities. So early on Berkeley activists began building a coalition that included African-Americans and Latinos.

Carol McGruder works with the Berkeley chapter of the NAACP. She says she's involved as part of her focus on health in the African-American community. She says she was "very disappointed" when New York City's local NAACP sided against the ban on large servings of soda that was proposed there.

“And in Richmond I know that big soda hired a lot of people from the community, from minority groups, to do telephone polling against it,“ McGruder says.

The Berkeley pro-tax campaign is also tapping into a broad network of community groups. Take the Ecology Center. It's been around for more than 40 years, and is known for pioneering Berkeley's curbside recycling program.

The Ecology Center marshaled resources including campaign foot soldiers like 22-year-old Kad Smith, who works on nutrition programs for the center. He’s spending weekends canvassing, and his evenings phone banking.

“Our message is that there is an overwhelming and urgent health crisis in our community,” says Smith. "We see those disparities especially in south and west Berkeley, which is a low-income community, which is also populated by a lot of people of color. It’s an overwhelming health crisis with obesity, diabetes.”

The "yes" campaign is also drawing support from outside the community. Former New York City Mayor Michael Bloomberg, who tried and failed to put a cap on the size of sodas sold in that city, recently donated $85,000 to the Berkeley effort.

Big Money From a Big Opponent

Drive around Berkeley and you will see bright red “Yes on D” signs blooming in yard after yard, suggesting the measure's success is at hand. But the beverage industry is very good at fighting this fight, very good at sowing doubt about the benefits of this kind of tax. So far they've spent more than $1.6 million dollars in Berkeley.

At the Ashby BART station, it’s easy to see where some of that money is going. There are signs everywhere that say, “Measure D is not what is seems.” A bunch of them have a big piece of glossy fruit that on the outside looks like an apple and on the inside looks like an orange. The tagline says, “On November 4th, vote no on Measure D.”

Katie Merrill is a democratic political strategist based in Berkeley. She says the beverage industry's tactics work. It’s easier to kill this kind of measure than to pass it.

“You're hearing the measure is flawed, it won't do what it says it will; the money won't be spent in the way that the proponents say it will.” says Merrill.

The beverage industry argues there's no guarantee the tax income will support school gardens or other health programs. Instead it will end up in Berkeley's general fund, where it could be used to pay for anything.

Campaign spokesman Roger Salazar says the anti-tax support is coming from some unions and small businesses.

Joshua Kemper owns one of those small businesses, Smokey J’s BBQ on Shattuck Avenue. Campaign fliers for No on D cover the tables in his small restaurant. He says the tax could hurt his business.

“It would be passed onto the people that buy stuff here," Kemper says. "That’s increasing the cost of the overall food. They’re spending more money when they come here, but I don’t see any of that.”

To get their message out, the no campaign is also paying teams of young people, some from as far away as Hayward, who are going door to door, every day until the election. They're articulate and very persuasive. Salazar says they're relying on that kind of street outreach.

“They go out, share the information that we have,” says Salazar. “Encourage them to read the initiative for themselves.”

Is Big Soda The Next Big Tobacco?

“Berkeley vs. Big Soda” is the official tag line of the Yes on D campaign. The slogan is featured on their t-shirts, their yard signs, and is even the campaign's website URL. Proponents argue that there are parallels between the soda industry and tobacco companies.

The Yes on D campaign even hosted a forum called “Is Soda The New Tobacco,” featuring Stan Glantz, a UCSF professor of medicine who has long fought for public health policies, including tobacco taxes to reduce smoking.

Political strategist Katie Merrill says those who think they can take on the soda industry should consider it a long haul.

“The soda industry is not the tobacco industry, it's not the oil industry,” says Merrill. “People haven't spent 30 years in high visibility battles against the soda industry”