California is one of the first states to make quality information on health plans available to consumers, ahead of the 2016 federal requirement. The federal government, which is running the marketplaces in 36 states, is not yet providing quality data and hasn’t released regulations guiding states on how they should.

States that are reporting quality information or are planning to this year, including Colorado, Maryland and Connecticut, have taken different approaches. Some are linking consumers to existing report cards, while others are creating new measures.

The decision over whether to make the California’s ratings public sparked a contentious debate last year among consumer advocates, health plans and the staff and board members of Covered California.

Covered California initially planned to not post quality ratings to the website, but consumer advocates pushed back. Anthony Wright, executive director of Health Access California, said this week that the quality ratings “make insurers compete not on avoiding sick people but on cost and quality.”

Insurers with longstanding histories in the commercial market urged the exchange to post star ratings on the website as soon as possible. They argued that consumers deserved to know that their plans had performed well in customer satisfaction surveys and in the perceived quality of the care provided to patients. But other plans urged the board to postpone putting the ratings on the website, saying that they would be at a disadvantage because they were newer to the commercial market or didn’t have a score.

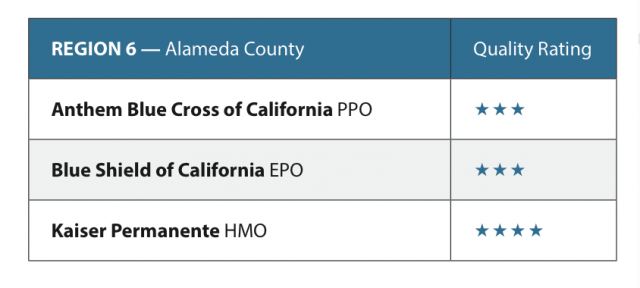

Covered California Executive Director Peter Lee said the ratings are preliminary but will help consumers as they choose health plans in their regions. The exchange plans to add more thorough quality information in the future, including both clinical data and member surveys on hospitals, medical groups and physicians.

The consumer quality data is divided by region. In Los Angeles County, Kaiser Permanente was the only insurer that received the top rating of four stars. In Sacramento, Western Health Advantage and Kaiser Permanente received four stars.

The controversy underscores the issues facing the health marketplaces as they decide what kind of quality information to make public about the plans and when to do so.

“It’s important to take on quality because it can really translate to better outcomes or worse outcomes,” said Sarah Thomas, a vice president at the nonprofit National Committee for Quality Assurance. “It can really affect health.”

Consumer advocates said they hoped that more information about medical outcomes and patient safety would be available soon.

“Is it all we want? No,” said Betsy Imholz of Consumers Union. “It’s a first step.”