The new campaign unveiled on Thursday in Sacramento is led by familiar faces, like the American Lung Association and the American Heart Association. It also has some political heavyweights, including the California Medical Association and SEIU California.

The coalition believes the money should be used to fund existing, and successful, state tobacco treatment and prevention programs. And the campaign, launched on the same day as the annual Great American Smokeout, is for a tax increase either by the Legislature on via the statewide ballot in 2016.

Getting that tax increase inside the halls of the state Capitol would be especially tough, given that it would likely require a supermajority vote of both the Assembly and Senate -- which, after this election, means votes from both Democratic and Republican legislators. The odds are daunting; a similar bill was invisibly killed earlier this year in the state Senate.

Then there's the ballot.

A slim majority of voters who cast ballots in June 2012 said no to the last tobacco tax proposal, Proposition 29. The initiative, an effort to increase the tax by $1 a pack and use the money for cancer research and other programs, lost by fewer than 30,000 votes out of more than 5 million cast statewide. Tobacco companies shelled out some $45 million to kill Prop. 29, painting it as a poorly written and bureaucratic boondoggle. Right or wrong on that front, Big Tobacco squeaked out a win.

A number of groups eyed a rematch in 2014, with one prominent effort suggesting a tax hike earmarked for funding colleges and universities. Those ideas, though, were later dropped.

Still, it's possible that tax supporters who were massively outspent in 2012 could have some heavy financial firepower this time. Doctors and insurance companies, fresh off their $59 million victory over a medical malpractice initiative this fall, could probably pony up some serious cash.

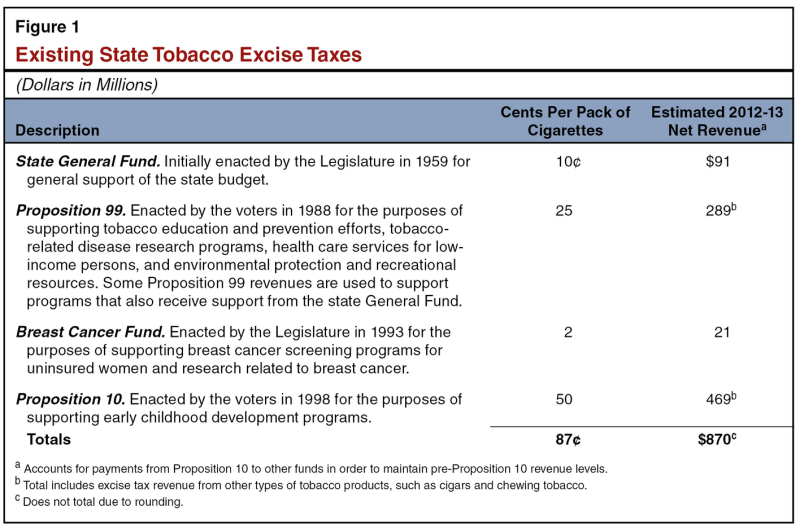

Policy-wise, tobacco taxes have always been an interesting -- and not so clear-cut -- issue. Analysts have long noted the tax's generally regressive nature; a 2009 national study estimates that the economic burden of a tobacco tax is about 10 times larger on the poorest Americans than it is on the most wealthy. Then there's the issue of how best to use the tax revenues, which an analysis of this year's failed legislation (also calling for a $2-a-pack increase) estimated at $1.4 billion a year. Some groups believe that legislators should have discretion in how to use tobacco tax revenues, though ballot initiatives are usually built around rigid guidelines -- lest voters think that elected officials might be able to waste the cash.

No doubt all of these issues will come up again in 2015 and 2016, even if supporters of boosting California's relatively modest tobacco tax tell everyone that it's a no-brainer.

In theory, they might be right. But, remember, there's a reason -- several reasons, in fact -- that Californians haven't been forced to pay more for their smokes in a very long time.