"None of these new revenues can be spent on state bureaucracy or administrative costs," says the opening section of the initiative.

Even so, Brown's letter admits that the result of those taxes will be a lessening of the fiscal burden now borne by the state budget.

"The stark truth is that without new tax revenues, we will have no other choice but to make deeper and more damaging cuts to schools, universities, public safety and our courts," he writes.

The income tax hike on those making $500,000 and above, combined with the half-cent sales tax hike for everyone, is estimated to be worth $7 billion a year -- leading legislative Republicans to instantly brand it a "$35 billion Tax Increase."

The proposal's targeting of schools and local services certainly helps identify two of the pillars of the coalition Brown now needs to build. While the state's most powerful teachers union has kept quiet, many believe it will be the governor's camp. As for locals, who helped Brown craft this year's major realignment of state and county services, the next few weeks will be intense.

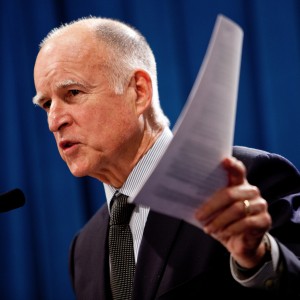

Last week, Brown addressed the annual meeting of the California State Association of Counties (CSAC), and used the speech to urge the organization to join his fledgling effort rather than campaign on the realignment initiative the group filed earlier this month.

"We have to make a decision very soon," said CSAC executive director Paul McIntosh, "as to whether or not to proceed with collecting signatures."

McIntosh says the leaders of the county organization likely want to work with the governor if possible. And an adviser to Brown says the governor is hoping the same spirit is out there among the various groups in organized labor and beyond that have their own tax-raising initiatives in the 2012 pipeline. If Brown can clear the field, the thinking goes, then he avoids a muddling of the tax debate during election season.

It's worth noting that the governor, who certainly seemed at home last week in the public eye selling his pension proposal to the public, chose to file the initiative in a low-key fashion and issue a written statement rather than angle for sound bites on the six o'clock news. The governor's camp seems to believe that until the campaign's coalition is fully formed, it's best to hold back on the PR blitzkrieg. Perhaps, too, we'll then see a campaign dominated by images of teachers, firefighters, and cops (where have we heard that phrase before?) rather than the state's chief politician?

The real question, of course, may be whether a well-funded opposition campaign forms. While it didn't take money to beat back the last electoral campaign on taxes in 2009, California's business community will no doubt be closely watched for clues about the road ahead. Many believe the governor's plan was crafted with an eye towards political balance -- by including a sales tax hike, even though it's unpopular with many Democrats.

And the 2012 budget saga is just starting; stay tuned for official word on the 'trigger cuts' next week.