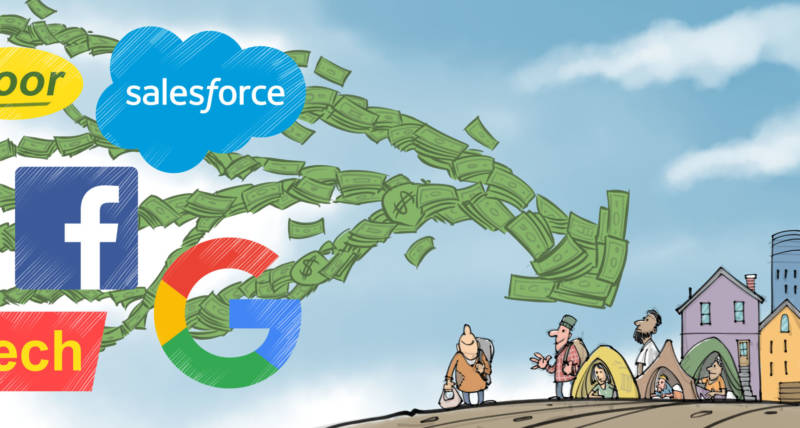

In the biggest move to address the city's homeless crisis in decades, San Francisco voters approved Proposition C, a tax increase on corporations that would double the city's budget for homeless services. The measure was approved by 60 percent of the electorate.

Proposition C, which pitted Mayor London Breed, who opposed the measure, against proponent Salesforce CEO Marc Benioff, took a strong lead Tuesday night, with "yes" votes totaling nearly 60 percent in early counts — tallying about 44 percent of expected ballots.

"This is a major people's victory," said Jennifer Friedenbach, executive director of the Coalition on Homelessness, which sponsored Proposition C. "We're going to be able to transform the lives of folks who were out on the streets."

The controversial measure could still face hurdles to becoming law. Some opponents of Proposition C have said that a tax measure directing funding for a specific purpose (in this case, homeless services) requires approval from two-thirds of voters.

A state Supreme Court ruling last year opened up the possibility that a citizens' initiative like Proposition C could become law with a simple majority vote.