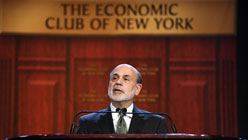

The phrase “fiscal cliff” refers to automatic tax hikes and spending cuts that are set to take place on January 1. They’re estimated to have an economic impact worth over $600 billion. Federal Reserve Chairman Ben Bernanke says it could send the economy “toppling back into recession.” Can President Obama and House Republicans reach an agreement before the Jan. 1 deadline?

Checking in on the Fiscal Cliff

(John Moore/Getty Images)

Guests:

Laura D'Andrea Tyson, S.K. and Angela Chan professor of global management at the Haas School of Business at UC Berkeley; former chair of President Bill Clinton's council of Economic Advisers (1993-1995); currently a member of the President's Council on Jobs and Competitiveness

David Wessel, economics editor at the Wall Street Journal and author of the books "Red Ink: Inside the High-Stakes Politics of the Federal Budget" and "In Fed We Trust: Ben Bernanke's War on the Great Panic"

Alan Viard, economist and resident scholar with the American Enterprise Institute; former senior economist at the Federal Reserve Bank of Dallas and a senior economist on the President's Council of Economic Advisors under George W. Bush

Sponsored